Introduction

If you would like to save money on credit card processing with GDpay, contact us today at [email protected] or 1-888-600-2602 to get started. If you’re not ready yet or not interested, that’s fine--you may still access all of this important information for free, without any obligations.

Why should I read this?

Credit Card Processing Secrets contains the truth about credit card processing that others don’t want you to know. By understanding how credit card processing works, you can quickly ensure you’re receiving the lowest rates for your company.

Much of the information out there is confusing or untrue.

Credit Card Processing can be easy to understand if it’s explained right.

Understanding = Savings.

Credit Card Processing’s Major Players

The credit card processing industry has four major players: issuing banks, acquiring banks, credit card companies, and processors or Independent Sales Organizations/Merchant Service Providers (ISOs/MSPs).

You don’t need to understand every little detail about the credit card processing industry, but you do want to have a basic understanding of these four major players in order to comprehend how rates are set: issuing banks, acquiring banks, credit card companies, and processors or ISOs/MSPs.

Issuing Banks

Acquiring Banks

Payment Brands

Discover operates somewhat separately from the Visa/MasterCard system, but their rates are usually very similar to the rates for Visa and MasterCard.

American Express works completely separately from all of this, within their own system. That means American Express has their own rates, and these rates do not change depending on which credit card processor you use.

Processors or ISOs/MSPs

Who gets my money?

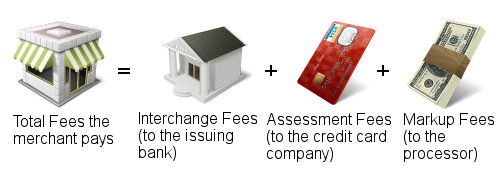

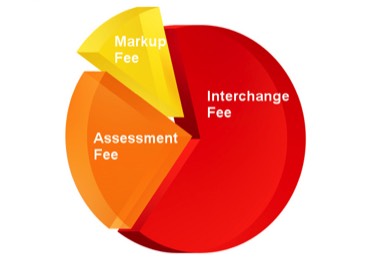

As a merchant, you pay credit card processing fees that go to

three different places: 1) the issuing bank, 2) the credit card company, and 3) the processor. The fees for #1 and #2 are set no matter who your processor is, so you want to search for a processor that takes out the smallest amount of fees for themselves.

Understanding where your credit card processing fees go is crucial to understanding how credit card processing works, and how to get the lowest rates.

Whenever you process a credit card, you are really paying three fees that go to three places: 1) An interchange fee, which goes to the bank that issued the credit card

2) An assessment fee, which goes to the credit card company (Visa, Mastercard, Discover, American Express, etc.)

3) A markup, which goes to the processor

The first two fees listed--to the issuing bank and the credit card company--are set fees that are the same no matter which processor you use. The third fee is different depending on which processor you use. To get the lowest fees possible, you want a processor that charges a lower markup. Let’s learn more about each type of fee.

Interchange Fees

Issuing banks set interchange rates collectively, which means the interchange rates charged stay the same no matter which processor you are using.

Assessment Fees

Here are the assessment fees for Visa, MasterCard, Discover, and American Express as of February 2014: Visa: 0.11% and $0.0195 per transaction MasterCard: 0.11% and $0.0185 per transaction

Discover: 0.105% and $0.0185 per transaction

Assessment fees are similar to interchange fees in the sense that they remain the same regardless of which processor you are using.

Processor Fees (also called “Markup”)

Total Fees

Your total credit card processing fees can be easily understood with this equation:

Total Fees = Interchange Fees + Assessment Fees + Markup

If you are interested in choosing a processor that has a low markup, contact GDpay today at

[email protected] or 888-600-6202. If you want to learn more about credit card processing, keep reading.

How do processors calculate their markup (fees)?

Processors calculate their markup fee in one of two ways: Interchange Plus Pricing or Tiered Pricing. Interchange Plus Pricing shows you clearly what you are being charged for, while Tiered Pricing bundles fees of different types together into tiers. The bottom line? Interchange Plus Pricing will save you more money.

You remember that interchange fees (charged by issuing banks) and assessment fees (charged by credit card companies) are fixed and do not change no matter which processor you go with.

The major difference between processors is how they calculate the markup fee they charge on these fixed costs. There are two ways to calculate markup: Interchange Plus Pricing or Tiered Pricing. Your overall processing fees will be lower using Interchange Plus Pricing. GDpay only sets merchants up with Interchange Plus Pricing.

The basic difference between pricing types is that with Interchange Plus Pricing, fees are calculated for each individual transaction, whereas for Tiered Pricing, many different types of transactions are lumped together in tiers, and you are charged the same rate for any transaction that falls into that tier. For more information on the two pricing types, keep reading.

Interchange Plus Pricing

Interchange Plus Pricing is easy to understand. Interchange Plus Pricing is transparent, meaning that for each and every transaction, you can see the exact amount of your total fee that went to the interchange fee, the assessment fee, and the markup. With tiered pricing, transactions are bundled together so these exact amounts remain hidden.

Interchange Plus Pricing refunds the interchange fee to you if your customer returns an item.

You pay interchange fees on each transaction. If one transaction is refunded, you get that interchange fee back. With Tiered Pricing, you do not get that fee back and do not even know how much it was.

Tiered Pricing

The Tiered Pricing structure groups transactions with different interchange fees into tiers (also called bundles or buckets). With Tiered Pricing, you pay one rate for all transactions that fall into a tier together. Examples of tiers that you might have heard of from other processors are “qualified,” “mid-qualified,” and “non-qualified.”

There are many problems with the Tiered Pricing structure.

Tiered Pricing costs you more overall because of hidden fees. Because Tiered Pricing bundles many types of transactions into one tier, some low-cost interchanges are hiding in high-priced tiers. On these transactions, you will pay a much higher amount than you would if the prices weren’t bundled.

Tiered Pricing is not transparent. With Tiered Pricing, you cannot look at a single transaction and easily see how your fee is broken down because you are paying a fee set for an entire group of different types of transactions. This makes it difficult to understand exactly what you are paying for.

Tiered Pricing charges you an inconsistent markup. Because transactions are bundled together, the portion of the fee that is the processor’s markup is different from transaction to transaction. Since the interchange and assessment fees aren’t made clear to you, it is nearly impossible to know what markup you’re being charged on a given transaction.

Tier Pricing increases several times per year, costing you more. Say there are over one-hundred different interchange rates bundled together into a single tier. If even just a few of those go up, the processor might raise the price of the entire tier. That means you are paying more on all of those transactions, even though the interchange fees on most of them didn’t go up.

Tiered Pricing doesn’t allow you to get the lowest interchange rate available to you. Lower interchange rates are available on certain transactions if you pass the correct type of data. Because you pay one rate for all transactions in a tier with Tiered Pricing, you will not receive a discount even if you pass the necessary data for a lower interchange rate.

Tiered Pricing keeps your interchange fee in the event of a refund. When a transaction is refunded, the issuing bank refunds the interchange fee. With Interchange Plus Pricing, this refund comes back to you. With Tiered Pricing, it does not, meaning you lose out on money that could’ve been yours.

How do I choose a processor?

You definitely want to choose a processor that uses Interchange Plus (not Tiered) Pricing, but that is not the only factor to take into consideration. Markup price, functionality, risk monitoring, customer service, and funding times are all important when choosing a processor.

Clearly you want to go with a processor (also called a merchant services provider or MSP) that uses the Interchange Plus Pricing structure rather than Tiered Pricing. This is the most important factor, but not the only factor. Not all processors using Interchange Plus Pricing are created equal. Other factors you want to consider while choosing a processor are markup price, functionality, risk monitoring, customer service, and funding times.

Price: Markup + Other Fees

Here’s how to figure out what that will cost you on a monthly basis: .0030 * (your average monthly sales volume) + $0.10 * (your average number of transactions per month)

If you average $10,000 sales volume a month over 200 transactions you will pay, on average, $50 in markup fees per month with the processor charging you 0.30% + $0.10. Here’s how: .0030 * $10,000 + $0.10 * 200 = $30 + $20 = $50

Please note that the processor still as communication costs so the $0.10 cents isn't all profit.

If you calculate this estimation of monthly markup fees for multiple processors and compare them to each other, you can easily determine who is offering you the lowest rate for the type of business you do. (Remember, however, this calculation only determines what your markup fee

will be. You will also be charged for interchange and assessment fees, but those need not be taken into consideration when comparing processors since they are fixed for everyone.)

In addition to the processor’s markup or rate, they will charge you other fees. It is important to ask about all of these other fees and take them into consideration when comparing processors. Other fees can include transactions fees, batch fees, annual fees, and more. The processor offering the lowest rate might not be the best deal for you if they have other fees that are high.

A processor should be willing to give you an easy-to-understand breakdown of your estimated total monthly fees after you share your sales information with them. To get a quote from GDpay, contact us now.

Price: Interchange Optimization

Functionality

Risk Monitoring

Customer Service

Reporting is also an important factor to take into consideration. Are you able to securely view all of your transaction history online? How detailed are your statements? GDpay provides detailed,

easy-to-read, transparent statements as well as access to a record of transactions you’ve run, available instantly.

Funding Times

Conclusion

Credit card processing can be confusing, and there are many processors out there who profit off of merchants being either misinformed or uneducated regarding how it works. We want you to be knowledgeable, however, so you can make an educated decision when choosing a credit card processor. Here are the main take-aways to keep in mind that are covered in this report:

Whenever a transaction is run, three fees are charged: an interchange fee (which goes to the issuing bank), an assessment fee (which goes to the credit card company), and a markup fee (which goes to the processor).

Processors charge merchants according to one of two fee structures: Interchange Plus Pricing (also called pass through pricing) or Tiered Pricing (also called bundled pricing). Interchange Plus Pricing generally saves merchants 20%, 30%, 40% or more on fees when compared to Tiered Pricing.

Switching to Interchange Plus Pricing will save your business money, but there are other factors to take into consideration when selecting a processor. Be sure to ask about their markup price and other fees, interchange optimization, functionality, risk monitoring, customer service, and funding times.